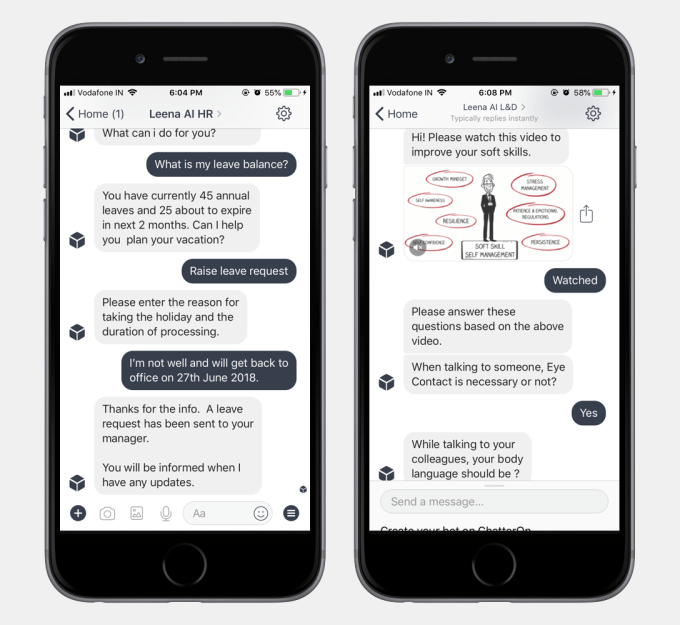

Say you have a job with a large company and you want to know how much vacation time you have left, or how to add your new baby to your healthcare. This usually involves emailing or calling HR and waiting for an answer, or it could even involve crossing multiple systems to get what you need.

Leena AI, a member of the Y Combinator Summer 2018 class, wants to change that by building HR bots to answer question for employees instantly.

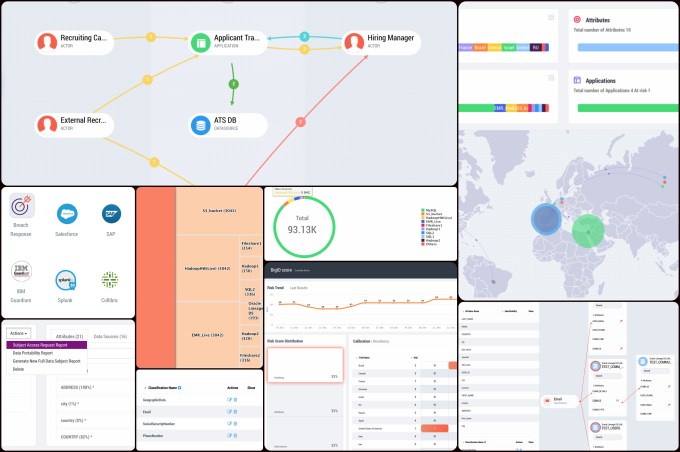

The bots can be integrated into Slack or Workplace by Facebook and they are built and trained using information in policy documents and by pulling data from various back-end systems like Oracle and SAP.

Adit Jain, co-founder at Leena AI says the company has its roots in another startup called Chatteron, that the founders started after they got out of college in India in 2015. That product helped people build their own chatbots. Jain says along the way, they discovered while doing their market research, a particularly strong need in HR. They started Leena AI last year to address that specific requirement.

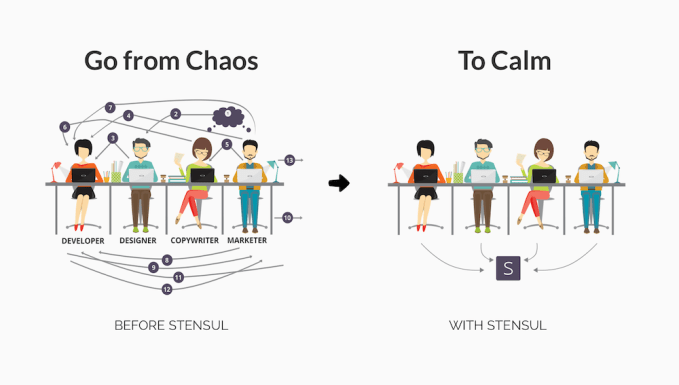

Jain says when building bots, the team learned through its experience with Chatteron, that it’s better to concentrate on a single subject because the underlying machine learning model gets better the more it’s used. “Once you create a bot, for it to really to add value and be [extremely] accurate, and for it to really go deep, it takes a lot of time and effort and that can only happen through verticalization,” Jain explained.

Photo: Leena AI

What’s more, as the founders have become more knowledgeable about the needs of HR, they have learned that 80 percent of the questions cover similar topics like vacation, sick time and expense reporting. They have also seen companies using similar back-end systems, so they can now build standard integrators for common applications like SAP, Oracle and Netsuite.

Of course, even though people may ask similar questions, the company may have unique terminology or people may ask the question in an unusual way. Jain says that’s where the natural language processing (NLP) comes in. The system can learn these variations over time as they build a larger database of possible queries.

The company just launched in 2017 and already has a dozen paying customers. They hope to double that number in just 60 days. Jain believes being part of Y Combinator should help in that regard. The partners are helping the team refine its pitch and making introductions to companies that could make use of this tool.

Their ultimate goal is nothing less than to be ubiquitous, to help bridge multiple legacy systems to provide answers seamlessly for employees to all their questions. If they can achieve that, they should be a successful company.

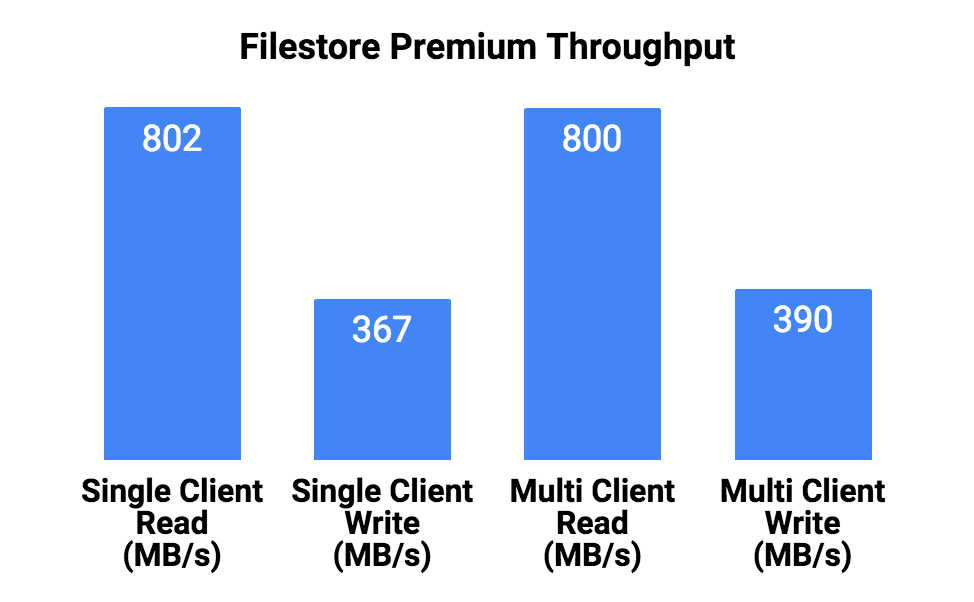

The promise of Filestore is that it offers high throughput, low latency and high IOPS. The service will come in two tiers: premium and standard. The premium tier will cost $0.30 per GB and month and promises a throughput speed of 700 MB/s and 30,000 IOPS, no matter the storage capacity. Standard tier Filestore storage will cost $0.20 per GB and month, but performance scales with capacity and doesn’t hit peak performance until you store more than 10TB of data in Filestore.

The promise of Filestore is that it offers high throughput, low latency and high IOPS. The service will come in two tiers: premium and standard. The premium tier will cost $0.30 per GB and month and promises a throughput speed of 700 MB/s and 30,000 IOPS, no matter the storage capacity. Standard tier Filestore storage will cost $0.20 per GB and month, but performance scales with capacity and doesn’t hit peak performance until you store more than 10TB of data in Filestore.